-- Et Obama a laissé faire ça?! Antisémite!

“It’s a Profoundly Jewish Affair”: Latest Wall Street Scandal

http://davidduke.com/its-a-profoundly-jewish-affair-says-tablet-magazine-of-latest-wall-street-scandal-involving-worlds-largest-hedge-fund/

Posted by

Staff

on August 13, 2013 at 9:01 am

“It’s a profoundly Jewish affair” is the comment made by the Jewish-run Tablet magazine

on the latest Wall Street scandal, this time involving one of the

world’s largest investors and hedge fund specialists, SAC Capital

Advisors LP.

There are no prizes awarded for guessing

that “SAC” stands for Steven A. Cohen, the company’s founder who was

called “the hedge fund king” in a 2006 Wall Street Journal article, ranked 94th on the top 100 list of most influential people by Time Magazine, and included in the 50 Most Influential ranking of Bloomberg Markets Magazine.

The government accused SAC Capital

Advisors LP of presiding over a culture where employees flouted the law

and were encouraged to tap their personal networks of contacts for

inside information about publicly traded companies.

The result was “insider trading that was

substantial, pervasive and on a scale without known precedent in the

hedge fund industry,” the indictment said.

The indictment filed by the U.S.

Department of Justice against SAC, together with a related civil case

seeking forfeitures and money laundering penalties, imperils the future

of the roughly $15 billion hedge fund.

It also may end Cohen’s career of

managing outside money, where he generated some of the hedge fund

industry’s best returns and became one of the foremost traders of his

generation.

The U.S. Securities and Exchange

Commission charged Cohen in a civil case with failing to supervise two

employees, Mathew Martoma and Michael Steinberg. Both men have pleaded

not guilty to criminal insider trading charges and face trials in

November.

The indictment said SAC’s illegal

practices ran roughly from 1999 to 2010. SAC and various affiliates were

charged with four criminal counts of securities fraud and one count of

wire fraud.

“When so many people from a single hedge

fund engage in insider trading, it is not a coincidence,” U.S. Attorney

Preet Bharara said at a press conference.

Bharara said that SAC was no less than a “magnet for market cheaters.”

According to the Jewish Tablet magazine,

the “SAC case is so fascinating to us unwashed masses in part because

more than being a mere workaday case of financial wrongdoing, it evokes a

literary—one almost wants to say Talmudic—discussion about the meaning

of language, the nature of information, and the essence of

interpretation. Or, in other words, it’s a profoundly Jewish affair.”

http://www.tabletmag.com/jewish-news-and-politics/139511/leave-steven-cohen-alone

The indictment of SAC Capital may be Talmudically interesting, but as government policy it’s a disaster

(...)

The comparison with American fiction’s great saga isn’t too

outlandish. The SAC case is so fascinating to us unwashed masses in part

because more than being a mere workaday case of financial wrongdoing,

it evokes a literary—one almost wants to say Talmudic—discussion about

the meaning of language, the nature of information, and the essence of

interpretation. Or, in other words, it’s a profoundly Jewish affair.

To understand what’s at stake, it helps to first know the law. Insider trading, according to the

Securities and Exchange Commission,

“includes both legal and illegal conduct,” generally referring to

“buying or selling a security, in breach of a fiduciary duty or other

relationship of trust and confidence, while in possession of material,

nonpublic information about the security. Insider trading violations may

also include ‘tipping’ such information, securities trading by the

person ‘tipped,’ and securities trading by those who misappropriate such

information.”

Confused? You should be. Because the devil, like all good attorneys,

is in the details, consider one of the indictment’s central tenets,

which, for purposes of clarity and drama, we’ll call the Case of the

Chatty California Caregiver. Simply put, the government alleges that SAC

ridded itself of stock after obtaining insider information from a

California doctor close to clinical trials conducted by the

pharmaceutical company Elan. That Elan’s own predictions were negative,

or that analysts overall agreed that the stock was one to dump, seemed

to matter little to Bharara, the attorney general who reached the

pinnacle of his fame with a

Time magazine cover

announcing that he was the man who was busting Wall Street. The stock

dropping, the prosecutor argued, followed advice the California doctor

illicitly whispered in the ears of SAC employees.

But a lengthy and eminently convincing

white paper,

prepared by SAC’s legal counsel, puts even this flimsy version to rest.

Presenting a minutely detailed account of the firm’s internal

communications, it shows that all on board were convinced that the

California physician was not privy to any nonpublic information and knew

well that the good doctor had not signed any confidentiality agreement

forbidding him from divulging what he had learned from conversations

with colleagues at Elan. Add to that the fact that the talkative

physician volunteered information of his own accord—the SAC analyst who

had called him had no intention of discussing Elan’s clinical trials—and

it’s easy to believe Cohen et al. when they argue that they believed

their precious source “was simply reporting what was both obvious and

public.”

And so, barring any hard evidence of concrete and carefully defined

wrongdoing, we ought to be deeply suspicious of any concerted federal

effort to exert so much pressure based on so little fact. But if the

government’s conduct in the SAC case is regrettable, it is also

fascinating. The more you dive into the case, the more you feel as if

Cohen and the federal government are enacting some loopy take on the

central intellectual struggle that had informed Jewish life for

millennia, with Cohen taking the rather goyishe stand that laws are laws

and anything not clearly defined is therefore clearly not punishable,

while the government approaches the case as Jews have traditionally

approached the Talmud, interested not only in the letter but in the

spirit, relishing every possible permutation, savoring every sliver of

meaning. The doctor we talked to signed no confidentiality agreement,

say the gentlemen at SAC, and he saw no secret data; therefore, talking

to him was kosher. Maybe strictly speaking, says the government, but

confidentiality agreement or not, with access to secret data or without

it, talking to a doctor close to the trials gave SAC an unfair

advantage. It’s the kind of logic one encounters in the Haggadah—the bit

about the rabbis debating just how many plagues God launched against

Egypt comes to mind—not in court. And it would be downright beautiful if

it weren’t unduly targeting a major financial firm for fame and

political fortune. It’s good to know that Cohen remains unfazed when

faced with these allegations and that he has his tuna to comfort him. Dayenu.

VIDEO -

VH1 - The Fabulous Life Of Wall Street Billionaires - Ballers - Full HD

These days nobody's making more and spending more than the buttoned-down badasses of Wall Street. From their sprawling estates and tricked-out private yachts to exotic vacation homes and multi-million dollar art collections-- these guys are living larger than anyone else on the planet. Welcome to The Fabulous Life of Billion Dollar Wall Street Ballers

Let's talk salaries people. Hedge Fund King Steven Cohen pulled in $1 billion in 2006. Financier Edward Lampert? He raked in $1.5 billion. That's right...in just one year. And you'd better believe these guys know how to spend their hard earned money too...especially when it comes to real estate. Billionaire investor Jeffrey Epstein? He lives in the absolute largest dwelling in all of Manhattan, a 51,000-sq-ft palace on E. 71st street. Eddie Lampert paid over $20 million for a magnificent waterfront property in Greenwich, CT...only to tear it down and rebuild. But of all the Wall Street spenders around, absolutely nobody can outdo Steven Cohen. He's got a 32,000-sq-ft Greenwich home complete with massage, exercise and media rooms, plus a full-size basketball court, tennis court, ice-skating rink and even a 700-square-foot house just for his Zamboni. Cohen has also spent over $700 million in just the past five years building one of the country's greatest private art collections, including works by Vincent van Gogh, Jackson Pollock and Andy Warhol. But not every Wall Street heavyweight digs fine art. Florida financier John Devaney? He spends his multi-millionaire dollar fortune on some very expensive toys including a private Gulfstream jet and TEN yachts. And these tycoons even turn charity into a massive spending spree too. In 2007, Wall Streeters raised $71 million for the poverty-fighting Robin Hood Foundation in just one night.

From their unbelievable mega homes to their mindboggling bonuses and the insane splurges that go with them...this is The Fabulous Life of Billion Dollar Wall Street Ballers.

Is Steven A. Cohen Buying Off the U.S. Government?

REUTERS - U.S. charges SAC Capital with insider trading crimes

http://www.reuters.com/article/2013/07/25/us-sac-fund-charges-idUSBRE96O0SD20130725

By Emily Flitter, Svea Herbst-Bayliss and Jonathan Stempel

NEW YORK |

Thu Jul 25, 2013 7:49pm EDT

(Reuters) - U.S.

prosecutors indicted billionaire Steven A. Cohen's hedge fund for

insider trading, a rare move that could end the career of one of Wall

Street's most successful investors and trigger a fundamental change in

how traders try to gain an edge over rivals.

The government accused SAC

Capital Advisors LP of presiding over a culture where employees flouted

the law and were encouraged to tap their personal networks of contacts

for inside information about publicly traded companies.

The

result was "insider trading that was substantial, pervasive and on a

scale without known precedent in the hedge fund industry," the

indictment said.

While not

personally charged criminally, Cohen joins junk bond financier Michael

Milken and Galleon Group hedge fund founder Raj Rajaratnam among

prominent Wall Street executives who have been linked to insider

trading.

The indictment filed by

the U.S. Department of Justice against SAC, together with a related

civil case seeking forfeitures and money laundering penalties, imperils

the future of the roughly $15 billion hedge fund.

It

also may end Cohen's career of managing outside money, where he

generated some of the hedge fund industry's best returns and became one

of the foremost traders of his generation.

Last

week, the U.S. Securities and Exchange Commission charged Cohen in a

civil case with failing to supervise two employees, Mathew Martoma and

Michael Steinberg. Both men have pleaded not guilty to criminal insider

trading charges and face trials in November.

Many

Wall Street firms that lend money to and trade with Stamford,

Connecticut-based SAC may stop or pull back because of Thursday's

criminal charges, though some said on they would take a wait-and-see

approach.

Cohen may yet be able to stay in

business because more than $8 billion of the fund's assets belong to him and his employees.

SAC said in a statement it has no plans to shut down.

"SAC

has never encouraged, promoted or tolerated insider trading and takes

its compliance and management obligations seriously," it said. "The

handful of men who admit they broke the law does not reflect the

honesty, integrity and character of the thousands of men and women who

have worked at SAC over the past 21 years. SAC will continue to operate

as we work through these matters."

VIRTUAL SLAM DUNK?

The

government's indictment of SAC Capital also will stand as the signature

action of its multi-year crackdown on insider trading in the $2.25

trillion hedge fund industry.

The

investigation burst into the open in October 2009 with the arrest of

Rajaratnam, founder of Galleon Group, and led to the conviction of more

than 60 people including Rajaratnam. But for authorities Cohen always

was the big fish to be caught because he loomed large over the hedge

fund industry.

In fact, when Cohen first opened shop,

hedge funds

were not well understood and the industry was a fraction of its current

size, with funds managing well under $1 trillion. But in large part

because of the success of firms like SAC Capital, hedge fund managers

surpassed investment bankers and even some bank chief executive officers

in terms of fame and fortune.

Over

the years, Cohen has been the subject of two Vanity Fair magazine

stories, countless front-page stories in The New York Times, and is

maybe just as famous in the art world for his prized collection of works

by Damien Hirst, Jeff Koons and Pablo Picasso.

More

recently, he tried to become the owner of the Los Angeles Dodgers

baseball team, but instead settled for a minority stake in the New York

Mets. As the scrutiny of Cohen and his firm has risen in recent year,

he's became more visible at hedge fund events, donating money to

charities and buying even more artwork.

Several

lawyers, including former federal prosecutors, said a decision not to

criminally charge Cohen might signal an admission that there is a

shortage of evidence against him.

But

the indictment does not preclude the government from gathering more

evidence and filing new charges later. Some lawyers believe the case

against SAC is strong now.

"It's

going to be a virtual slam dunk for the prosecution," said Solomon

Wisenberg, a partner at Barnes & Thornburg in Washington, D.C., and

author of "White Collar Crime: Securities Fraud."

"The

story is basically that there's a whole culture here where red flags

were ignored, (and) compliance efforts were more or less window

dressing."

The Justice Department's

decision to indict SAC, and not just individuals, is an unusual move

that underscores prosecutors' belief about the pervasiveness of the

alleged insider trading.

Prosecutors

have shied away from indicting large financial firms after their 2002

case against Enron Corp's auditor, Arthur Andersen, helped put that firm

out of

business.

The

indictment comes after a seven-year investigation of SAC and amid a

broader crackdown on insider trading that has resulted in more than 70

convictions and guilty pleas.

It is as much a forceful reproof of an era of free-wheeling trading by

hedge funds

as it is a condemnation of SAC's culture as an alleged breeding ground

for traders and analysts who traffic in illegal tips about corporate

earnings and buy-outs.

The

indictment said SAC's illegal practices ran roughly from 1999 to 2010.

SAC and various affiliates were charged with four criminal counts of

securities fraud and one count of wire fraud.

"When

so many people from a single hedge fund engage in insider trading, it

is not a coincidence," U.S. Attorney Preet Bharara said at a press

conference. He declined to address how much money the government will

seek to have SAC forfeit.

U.S.

District Judge Laura Taylor Swain will oversee the criminal case, and an

initial hearing is scheduled for Friday morning. A colleague, U.S.

District Judge Richard Sullivan, will oversee the civil forfeiture case,

according to court records.

In Washington, lawmakers critical of prosecutors' past efforts to go after Wall Street heavyweights applauded the indictment.

"They

deserve credit for taking on a big, challenging case," said Senator

Chuck Grassley, a Republican of Iowa whose office has conducted its own

probe of Cohen and SAC Capital.

"LIKE A MOVIE"

Launched

in 1992 with just $25 million, SAC became the most successful hedge

fund to rely on the so-called mosaic theory of investing, which builds

investment theses on

stocks by gathering information from multiple sources.

Cohen has been able to generate average annualized returns of 25 percent, far outpacing most rivals.

That

has helped him to charge a 3 percent management fee and keep 50 percent

of investment profits. A typical hedge fund manager gets a 2 percent

fee and 20 percent of the profits.

SAC's

success has also enabled Cohen to spend well, and he has become known

for his collection of expensive art and real estate holdings. Cohen

recently paid casino mogul Steve Wynn a reported $155 million for Pablo

Picasso's "Le Rêve," and owns properties valued well into eight figures.

Many

investors stuck with Cohen despite years of speculation about improper

trading. But over recent months they requested about $4 billion in

withdrawals as investigators closed in.

SAC generates more than $300 million annually in trading fees for Wall Street brokerages large and small, such as

JPMorgan Chase and Co and Jefferies & Co.

Although

SAC has $6 billion to $8 billion of cash, according to people familiar

with its finances, some question how effectively it can operate. "It's

an ugly situation," said an executive at one counterparty.

On

Thursday, extra security was posted outside SAC's Stamford office, and

reporters were kept far away. One employee at the firm's New York office

said there were no recent internal signs of panic or anxiety. "It's

like a movie," he said.

COOPERATING WITNESSES

Prosecutors

built their case against SAC with help from several former employees,

including Noah Freeman, Jon Horvath, Donald Longueuil and Wesley Wang,

who pleaded guilty to charges of criminal insider trading.

Among suspect trades was Cohen's August 2008 sale of a $12.5 million stake in

Dell Inc,

launched within 10 minutes after he was forwarded an email in which

Horvath told Steinberg, based on a "2nd hand read from someone at the

company," that the computer maker's earnings would disappoint.

Cohen's lawyers this week said he never read that email.

The

indictment also alludes to Cohen hiring a new employee, Richard Lee,

despite a warning that he had been in another fund's "insider trading

group." Lee pleaded guilty on July 23 to securities fraud and conspiracy

involving trades in Yahoo Inc and 3Com Corp.

The

indictment does not identify the fund, but a person familiar with the

matter said it was Kenneth Griffin's Citadel Investment Group. Citadel

managed roughly $13.3 billion at year end.

A

Citadel spokeswoman, Katie Spring, said Lee was fired in 2008 for

breaching company rules, not insider trading. "There is no insider

trading group at Citadel," she added.

The

criminal case is U.S. v. SAC Capital Advisors LP et al, U.S. District

Court, Southern District of New York, No. 13-cr-00541. The civil case is

U.S. v. SAC Capital Advisors LP et al in the same court, No. 13-05182.

(Reporting

by Michael Erman, Emily Flitter, David Henry, Lauren Tara LaCapra,

Jonathan Stempel, Bernard Vaughan and Katya Wachtel in New York; Svea

Herbst-Bayliss in Boston; Peter Rudegeair in Stamford, Connecticut; and

Sarah N. Lynch in Washington, D.C.; Editing by Matthew Goldstein, Grant

McCool, Paritosh Bansal, Dan Grebler, Leslie Adler)

Goldman Sachs chief: Rabbi, Jewish groups helped me succeed Mais c'est un stéréotype antijuif quand c'est un Goy qui le dit...

N.Y. Jewish council head being probed over ‘financial irregularities’

What Would the Jewish Supremacists Say if Any Country Barred Jews from Housing Developments?

Justice Denied: The Marc Rich Case – Part I and II.

Polish Forbes magazine apologizes to Jewish leaders

Jewish Lobby in Poland Blackmails Forbes into Apology

Israeli billionaire Steinmetz loses Guinea mining permits over alleged corruption

Guinea’s

government has accepted a report recommending the cancellation of two

iron ore concessions held by Israeli billionaire...

Head of Israel's National Fraud Squad accused of corruption

FBI arrests friend of pro-Israel Rep. Michael Grimm on charges of election fraud related to donations

Cantor Tied to Controversial Rabbi at Center of Probe

US congressman to face charges over Pinto-linked funds Republican Rep. Michael Grimm said to have received illegal contributions from followers of Israeli rabbi

2 US Citizens Flee To Israel After Being Accused Of $33M Bank Fraud

Obscene wealth: World’s 85 richest people have same wealth as 3.5 billion poorest

Larry Ellison remains world’s wealthiest Jew

Larry Ellison remains world’s wealthiest Jew Ça n'empêche pas Sheldon Adelson de s'autoproclamer "le juif le plus riche au monde"

Lights! Camera! Jews! Blockbuster flicks featuring swindlers like ‘Wolf of Wall Street’ and ‘American Hustle’ are up for Oscars. J.J. Goldberg wonders what this says about how America sees its Jews.

New IRS Targets

This upcoming tax season entails some unpleasant surprises for United

States citizens who either live in Israel or who hold bank accounts

there.

Rappel:

Coup de filet de l'IRS contre l'évasion fiscale vers les banques israéliennes

Americans in Israel urged to resist new U.S. oversight of their bank information Association of Americans and Canadians in Israel says U.S. legislation making Americans' lives a nightmare.

Ils disent Américains, mais il faut comprendre juifs à l'étranger (Ha'aretz s'adresse aux Israéliens)

Madoff says Ponzi scheme was not betrayal of the Jewish people

Madoff: I betrayed people, not specifically Jews

Our Convenient Scapegoat: Bernie

Madoff is not a victim, but he is a scapegoat. It’s easier to blame one

thief than to wrap our minds around a corrupt system of

hyper-capitalism, writes Jay Michaelson.

Que ce soit Madoff le coupable ou qu'il soit rien de plus qu'un bouc émissaire de l'hypercapitalisme, les responsables sont toujours les mêmes...

Rabbi among 4 indicted in $12.4 million theft of NY special ed funds

US rabbi charged with stealing $12.4 million from disabled kids

L’ancien Premier ministre israélien Ehud Olmert condamné pour corruption

Olmert guilty of corruption For first time in history former-PM convicted. Judge: Olmert took bribes and lied in court.

Olmert facing up to 6 years in prison

Police to question real-estate mogul in connection to Olmert 'hush money'

Ex-Jerusalem mayor gets 6 years for taking bribes Uri Lupolianski funneled hundreds of thousands into charity, was convicted alongside former PM Olmert in the Holyland affair

L'ancien maire de Jérusalem est condamné

– L'ancien maire de Jérusalem a

été condamné jeudi à six ans de prison pour son rôle dans une vaste

affaire de corruption qui a aussi touché l'ancien premier ministre Ehoud

Olmert.

US congressman to face charges over Pinto-linked funds Republican Rep. Michael Grimm said to have received illegal contributions from followers of Israeli rabbi

Met Council’s William Rapfogel sentenced to 3 1/3 to 10 years in prison William Rapfogel, the former chief of New York’s Metropolitan

When William Rapfogel wanted to expose scandals

Former CEO of NY’s Metropolitan Council on Jewish Poverty sentenced to only four month’s prison for $9 million kickback scheme

Le braquage du siècle est séfarade

Cyril Astruc, le super-escroc juif, porte plainte

Cyril Astruc poursuit Égalité & Réconciliation pour diffamation

Dans l’article « Escroquerie à la taxe carbone : 1,6 milliards de

pertes pour le fisc français », nous revenions sur le gigantesque casse

du siècle que nous avons depuis décrypté en profondeur pour nos lecteurs

dans l’article «

Le braquage du siècle est séfarade ».

Le milliardaire Carl Icahn dans le viseur du FBI et des autorités financières

Carl Icahn serait sous le coup d'une enquête pour délits initiés, Etats Unis

Qui est

CARL ICAHN?

Certains de vos confrères et consoeurs sont des gens de gauche?

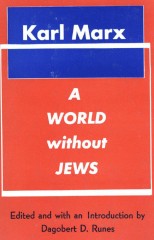

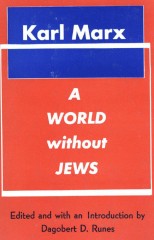

Alors dites-leur de lire au moins TOUT Marx!

Par Balder le samedi 17 août 2013, 20:12 -

Marx Karl

- 22 lectures

Author :

Marx Karl

Title :

A world without jews

Year : 1959

Link download :

Marx_Karl_-_A_world_without_jews.zip

It is with some reluctance that I have agreed to write these

introductory lines to Karl Marx's embittered review of the Jewish

problem. My reluctance is caused by the awareness that the Marxian type

of anti-Semitism is still virulent among those furtive few who find in

Jew hatred a compensative way of living out the envies of their drab

existences. On the other hand, our present era has been offered the

repeated spectacle of the yellow badge of anti- Semitism attached to

banners allegedly flying for Socialism. Almost a generation ago, the

National Socialist Party of Germany adorned its Staffel with that badge,

and in our living days the red flag of the Soviet Union carries next to

the hammer and sickle the hooked cross. Was it just an ill wind of

history that brought the evil odor of Jew hatred into these humanitarian

camps of Socialist movements? Or are we faced here with a situation of

direct cause and effect? I should like to cite a few paragraphs from the

booklet that lies before you. These lines which I am quoting are not

from the pen of Adolf Hitler or Colonel Nasser, but verbatim

translations from the German original of the Father of Socialism, Karl

Marx: "Money is the zealous one God of Israel, beside which no other God

may stand. Money degrades all the gods of mankind and turns them into

commodities. Money is the universal and self-constituted value set upon

all things. It has therefore robbed the whole world, of both nature and

man, of its original value. Money is the essence of man's life and work,

which have become alienated from him: this alien monster rules him and

he worships it. "The God of the Jews has become secularized and is now a

worldly God. The bill of exchange is the Jew's real God. His God is the

illusory bill of exchange. "What is the foundation of the Jew in our

world? Practical necessity, private advantage. "What is the object of

the Jew's worship in this world? Usury. What is his worldly God? Money.

"Very well then: emancipation from usury and money, that is, from

practical, real Judaism, would constitute the emancipation of our time."

Some readers may raise the question in their minds, what attitude are

we to take toward this man who was himself a Jew? To those readers, I

reply that in the middle of the nineteenth century anti-Semitism was

mainly a religious and social, not a racial, issue, and among converts

such as Karl Marx are to be found vitriolic enemies of Judaism. The

convert as a tool in the hands of professional Jew baiters is to be

found as early as the Middle Ages in the person of the Jew Pfefferkorn

who assisted in attempts to put Jewish sacred literature to the torch.

And little more than ten years ago in the Soviet Union, the Jew Ilya

Ehrenburg led the attack against Jewish writers as being cosmopolitan,

non-patriotic and Zionist. This he did at the grave of almost eight

hundred Yiddish poets, writers, and novelists who had been executed at

the behest of Stalin. Karl Marx was not only born a Jew; he came from a

rabbinical family. His father Heschel Marx accepted Christianity in 1816

in order to practice law in Prussian territory. Like many converts,

Marx found it necessary all his life to justify the mass conversion of

his family by attacks against his blood brothers. Anti-Semitic

expressions of his are to be found mainly in the present essay, in his

Class Struggles in France, In the Eighteenth Brumaire of Louis

Bonaparte, and in his Letters to Engels, censored by Bebel and

Bernstein. Some of the editors of his writings attempted to modify the

vindictiveness of Marx's aggression. Others, like Mehring, even

intensified them. I should like to quote at random a few more examples

of Marxian Jew baiting: "It is the circumvention of law that makes the

religious Jew a religious Jew." (Die Deutsche Ideologie, MEGA V, 162)

"The Jews of Poland are the smeariest of all races." (Neue Rheinische

Zeitung, April 29, 1849) He called Ferdinand Lassalle, "Judel

Itzig—Jewish Nigger." (Der Judische Nigger, MEKOR III, 82, July 30,

1862) "Ramsgate is full of Jews and fleas." (MEKOR IV, 490, August 25,

1879). The identification of Judaism with usury and exploitation of the

masses, combined with an alleged secret master plan of the Jews with

headquarters in Jerusalem to dominate the rest of the world, has been,

and still is, the fundamental platform of political anti- Semitism.

Copies of Hitler's Mein Kampf and Russia's Protocols of Zion have only

recently been distributed by Khrushchev's close ally, Colonel Nasser.

The late President Zapotocki of Communist Czechoslovakia declared at the

time of the mass trials of Jews within the Soviet empire, in reply to

protest from the free world, "We will not submit to the Jerusalem-New

York axis." Today in Marxist Russia no Jewish magazine or newspaper may

be published, no Jewish cultural center may function, no Jewish rituals

may be publicly observed. No Jew may hold major public office or be a

member of the Soviet parliament, and even harboring any expression of

Zionist character is dealt with as a capital offense. We also note that

in other sectors of the Soviet empire Marxian anti-Semitism is visible.

Mao Tse- Tung, the undisputed leader of Red China, declared Israel to be

"the Formosa of the Mediterranean" which should be swept into the sea.

The Socialist Nehru of India, an ardent admirer of Colonel Nasser, does

not permit the liberal and democratic State of Israel to open an

embassy, or even a consulate, anywhere in India. The German as well as

the Russian forms of Socialism, be they national or international, have

never freed themselves of the taint of a malevolent Jew hatred. And

while among the peoples of the free world anti-Semitism has not been

completely eradicated, in the West it is only the lunatic fringe that

launches propaganda against the Hebrews, while in the Communist domain,

the governments themselves spearhead the drive against the ancient

people. ...

Sur ce blog:

Police anti-corruption ou anti-juive? Deux politiciens juifs de Montréal, incluant le premier maire juif de Montréal, arrêtés par l'unité permanente anti-corruption de la Sûreté du Québec

Le grand rabbin ashkénaze d'Israël, qui remerciait Bush pour la guerre en Irak, arrêté pour fraude et blanchiment d'argent

Forbes Israël fait des listes de milliardaires juifs... mais aucun Rothschild n'y figure, c'est bizarre non?

Affaire Vivendi: Edgar Bronfman Jr évite de peu la prison

Les

massmédias juifs antijuifs? Le directeur des organisations

internationales pour le congrès juif mondial et l'ex directeur de la

branche états-unienne du WJC, Shai Franklin: "oui il existe un lobby

juif"

Les massmédias anti-juifs? Netanyahou caricaturé le jour de la mémoire de l'Holocauste

Les massmédias anti-juifs? Ils disent où va l'argent des universités

Les massmédias anti-juifs? Un Tweet d'une correspondante de la BBC à Washington réfère au pouvoir et à l'argent du lobby juif

Maîtres du monde, maîtres de l'humour: Netanyahou accuse le New York Times et Haaretz de donner le ton de la campagne anti-Israël à travers le monde

Coup de filet de l'IRS contre l'évasion fiscale vers les banques israéliennes

L'administration Obama attaque Goldman Sachs

Enquêter sur Goldman Sachs serait antisémite

Le président Obama sur la même ligne que l'ex-directeur de l'Unité de traque de Ben Laden à la CIA, Michael Scheuer: "peu importe qu'Israël survive ou pas"

Moins d'argent juif de New York pour Obama, plus d'argent juif de Las Vegas pour Romney

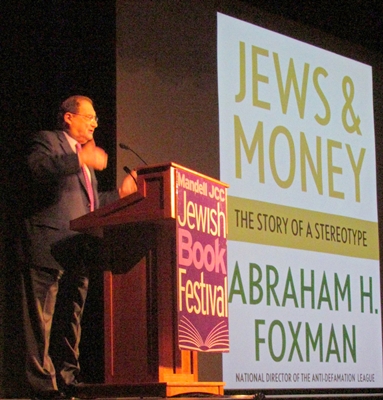

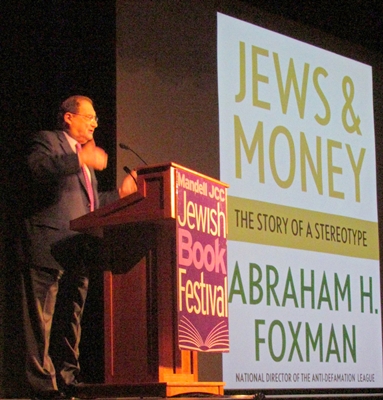

La ligue de diffamation "couvrirait les malversations de l'élite financière"

La

LDJ canadienne se plaint de harcèlement policier et autres

persécutions, orchestrées par des groupes palestiniens et musulmans

Abattage de l'économie et holocaustes des nations

"Nos excuses au Congrès juif, mais il y a une mafia juive. Et c'est la mafia financière..."

Blanchiment d'argent, corruption, trafic d'organes... c'est pas bon pour l'image de la communauté!

Une croquée de plus de 50 milliards

Le Madoff de Miami, Scott Rothstein: 50 ans de prison pour un Ponzi de 1.2 milliards de dollars

Le Madoff torontois Tzvi Erez et son Ponzi de 27 millions de dollars

Plus canadien que les Canadiens: Reichmann roi de l'immobilier

Les grandes fortunes familiales qui contrôlent la finance et les affaires

The New Babylon: extraits

Les dessous de l'empire Rothschild

La montée du pouvoir financier juif Rothschild

Des leaders nés!

Enron aussi?

Réunion Bilderberg 2010

Qui contrôle les États-Unis?

Contre le ZOG ("Zionist-Occupied Government"): À quand un mouvement "Un-Occupy"? Que les forces d'occupation se retirent

"Au moins 139 des 400 plus grands milliardaires sont juifs" Non seulement ils l'admettent, ils le proclament!

Les zaffaires zont bonnnes...

Les rois du crime organisé, c'est pas les Italiens...

Les nazis ont fait la vie dure aux Rothschild, confisqué leurs avoirs

Du mythe des nazis "pantins de la ploutocratie internationale"